PUTRAJAYA, July 17 – The opposition Democratic Action Party (DAP), in responding to a recent invitation from the Ministry of Finance (MOF) to discuss country’s economic recovery, has submitted a RM45 billion proposal – Recovery Plan and Stimulus Package – which calls for substantial investment in healthcare capacity and immediate sizable fiscal injection to support households and businesses.

In a statement today, DAP said the party’s delegation comprising DAP Secretary-General and MP for Bagan, Lim Guan Eng, Tony Pua (Damansara) and V Sivakumar (Batu Gajah) had a meeting with Finance Minster, Tengku Zafrul Aziz on Thursday, July 15, where they had taken the opportunity to present suggestions and the proposal via a memo to the minister.

Excerpts from the text of the memo, with details of the measures and expenditures that would be required as soon as possible to recover the people’s welfare and the country’s economy following the beatings from the COVID-19 virus and the Movement Control Orders, are as follows:

INTRODUCTION

Since the imposition of the nationwide full movement control order (FMCO) in June, followed

by Phase 1 of the National Recovery Plan, and the subsequent enhanced movement control

order (EMCO) this month in parts of the Klang Valley as well as other states and localities,

economic activity in the majority of sectors (especially those deemed nonessential) has

come to a standstill. This has negatively affected livelihoods, our supply chains and investor

confidence.

Vulnerable households and businesses risking insolvency that somehow scraped by

following the first two movement control orders in March 2020 and January 2021 may not be

as lucky this time around because they are surviving on emergency cash reserves. Many are

running out of it completely as evidenced by the growth of the #benderaputih movement.

While the Government has announced various assistance and stimulus packages, it is

important to bear in mind the insufficiency of these measures given the gravity of the current

FMCO and EMCO.

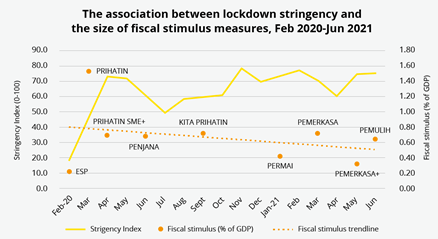

The chart below shows that the level of fiscal support has not been

commensurate with the damage to the economy caused by the various lockdowns,

especially this year.

As it stands, the direct fiscal spending through these programmes only amounts to RM87.6

billion or 16.5% of the total package value. With fiscal stimulus representing about 6% of

GDP thus far, this puts Malaysia below the global average of 9.2% of GDP spent as well as

below the G20 average.

The nature of the pandemic requires decisive fiscal action first and foremost to keep

livelihoods afloat, with non-fiscal measures acting as a complement to stimulate recovery,

especially in the longer run. This is especially important for Malaysia, given that we have

recently been ranked last among 50 major economies in terms of return to normalcy

according to The Economist.

We would like to propose a two-pronged expenditure strategy to mitigate and recover from

the pandemic crisis:

(i) Substantial Investment in Healthcare Capacity

a. We need to increase testing and tracing capacity even as we ramp up

vaccination.

8 The Government must not again be presumptuous that with lockdowns

and vaccinations, testing and tracing is no longer a priority. The negligence and

failure in the current testing and tracing operations by the Health Ministry has

severely compromised the effectiveness of the current lockdowns.

b. We must increase the capacity of our healthcare system. The Government has

often justified the painful lockdowns on the basis of an overstretched healthcare

system. However, that is because the Government has not planned or prepared for

the eventuality and failed to urgently invest in healthcare capacity over the past year,

despite intermittent lockdowns, which has resulted in the severe stress on the

healthcare system in recent months.

(ii) Bold Expansionary Fiscal Policy to Support Households and Businesses

a. The MoF must introduce a comprehensive, sizable fiscal injection now instead of

depending on half-hearted, overly cautious expenditure as it has done in the past. If

there is insufficient spending in strategic areas now, this would require the

government to ramp up spending on welfare in the upcoming months resulting from

the inability to save jobs and businesses.

b. The bold expansionary fiscal policy must complement and be coherent with a major

review of the current pandemic risk control measures. We must move past the

arbitrary distinction between ‘essential’ and ‘non-essential’ sectors when

differentiating ‘lockdowns’. It does not make any sense for many low-risk

‘non-essential’ sectors to be shut, while certain potentially high-risk ‘essential’

industries are left to operate without any revision in guidelines or standard operating

procedures (SOPs).

Instead, every industry must be risk assessed via science-based and data-driven

SOPs, ensuring there is pre-emptive risk assessment in accordance with the risk of

transmission, clearly distinguishing between indoor and outdoor spaces. A cafe, for

example, has a different risk-level compared to a pub or club, and cannot be

classified homogeneously as the F&B sector.

With the availability of MySejahtera

check-ins and tracing data, sectors with low incidence of transmission should be

looked into and arranged for re-opening.

In addition, the risk assessment of any business operation should evolve to account

for their indoor air quality. Belgium’s COVID-19 Commissariat for example, calls for

the CO2 content in indoor spaces not to exceed 1200 ppm under any circumstances,

as a proxy for the air quality and hence the risk of aerosol transmission of the virus.

c. Government assistance for businesses must go beyond providing them with liquidity

to help them tide over the current economic difficulties but also pave the way for

them to resume operations responsibly. It must assist them in investing in

‘pandemic-proofing’ work premises and living quarters for their workers to

minimise the possibility of infections and breakouts in the future.

d. We must provide monthly aid/social protection to households who are affected by

the pandemic crisis and measures so that no one is left behind.

RM45 BILLION INVESTMENT & EXPENDITURE

To deliver the above strategies, we would like to propose timely investment and expenditure

of RM45 billion into the economy:

(i) At least RM4 billion for the Ministry of Health

a. To accelerate the 3Ts of testing, tracing and treatment

The MoH must ramp up testing, and by extension keeping the test positivity rate well

under 5% is critical. We should not be hesitant to increase the number of tests for

fear of increasing the number of detected cases. Failure to have a comprehensive

testing strategy would mean a higher probability of community spread if positive

cases remain undetected.

Testing can be made even more effective by putting in place large-scale preventive

testing programmes, especially targeting high-likelihood populations such as foreign

workers living in dense dormitories, or residents of high-density housing blocks.

Beyond these large-scale programmes, self and rapid testing with RTK antigen test

kits should also be made widely available. This can enable testing at the “point of

interaction,” e.g. a factory floor or office, and even allow self-administered home

testing, as is now possible in several countries.

Funds must also be allocated to help decentralise testing activities to other entities

such as the state governments, local councils, businesses and even community

organisations to ensure that our testing capacity is not limited to the capacity of the

Health Ministry.

b. To enhance the quarantine process.

The Government must establish more quarantine centres (e.g. unutilised hotels) for

low-risk patients at the local and community level along with the recruitment of

necessary support staff. This will go a long way towards alleviating pressure from

public healthcare facilities.

In addition, the uncertainties that arise once a person is confirmed positive, including

the conditions in mega quarantine centres and the requirement to pay for the cost for

foreign workers, might dissuade people from coming forward to test. The government

must resolve these uncertainties.

c. Drastically ramp up manpower in the public healthcare system.

Ensure permanent postings for 35,216 contract health officers comprising 23,077

medical officers, 5,000 dental officers and 7,139 pharmacists as part of a holistic plan

to expand the health services sector to deal with the future load arising from

COVID-19, its potential variants and well as future infectious diseases.

d. To upgrade hospital capacity (especially ICU capacity), capability as well as

medical equipment and human resources to avert the collapse of our public

healthcare system.

As some hospital infrastructures might have reached their capacity limit,

considerations should also be made for purpose-built COVID-19 treatment centres.

The same approach has been taken before with the establishment of purpose-built

leprosy and tuberculosis centres. In the meantime, the Government should co-opt

more players from the private healthcare sector as part of the national ‘whole of

society’ strategy against the disease.

This is also an opportunity to raise spending on the public healthcare system from

roughly 2% of GDP in the past decade to closer to 4% in the longer term.

(ii) RM30 billion Financial Grants & Subsidies for the Economic Sector

a. RM15 billion investment in pandemic-proofing economic grants and soft loans,

matched with appropriate tax incentives to immediately ‘pandemic-proof’ work

places, factories and workers’ quarters. This will be in line with the recent ventilation guide introduced by the Ministry of Human Resources, with updated SOPs to optimise indoor air quality and ventilation as well as treating outdoor spaces as low risk with adequate social distancing and crowd control measures in place.

Relevant sensors (e.g. CO2 monitoring devices) can be deployed to measure air quality and air flow of premises before allowing them to operate. It should be noted that if businesses are struggling to stay afloat today, then it is

almost impossible to expect them to invest on their own accord to fully

‘pandemic-proof’ their premises. It is hence critical for the Government to intervene

to assist and minimise the potential of future outbreaks which will be disruptive for the

entire economy.

b. Economic grants and assistance must be targeted at small business owners who

have been worse hit by this pandemic. As an example, priority could be given to the

businesses that have had a large share of employees test positive for COVID-19,

businesses that started operations in 2020 and 2021 and businesses in the worst hit

sectors, such as F&B, retail and tourism.

c. Enhance social protection, especially for those in the informal and gig sectors of the

economy. This can be achieved by providing full payment, and subsequently a 50%

subsidy, for informal and gig workers to subscribe to the EIS programme. All workers

should also have a tax identification number to ensure no one is off the radar.

d. Introducing mandatory periodic subsidised testing regime at work places based on

risk assessment to ensure early containment of any potential outbreaks,

e. Loan guarantees and credit extensions for small and medium enterprises,

construction, retail and the crippled tourism industry. Tax exemptions alone will not be

of much use to businesses in struggling industries that are suffering due to lack of

liquidity and risk of insolvency.

In addition, the Government should evaluate existing bottlenecks when applying for

various schemes, such as BNM’s special relief package and TEKUN Nasional’s soft

loan package, which has ended up being more expensive than conventional bank

loans.

(iii) RM6 Billion in Work Hiring Incentives

a. Over a period of 2 years, comprising wage incentives of RM500 a month to local

employees and hiring incentives of RM300 per month to employers, creating

employment for 250,000-300,000 Malaysian workers. Youth unemployment is still at

a high of 13.4% in March 2021. The scheme can broadly adopt the

Malaysians@Work programme announced for Budget 2020.

b. Creating and preserving jobs should still be the first line of defence in saving

Malaysian livelihoods. The lack of investments in this area may lead to more

segments of Malaysians needing to rely on welfare aid to survive in the future.

(iv) RM5 Billion for Households

a. More than double the monthly welfare payments to carry households affected by the

lockdown until the end of the year. This proposal acknowledges the difficulties M40

families (as well as the overall middle class that transcends the M40 classification)

face, and will require upgrading payments announced in the recent Pakej

Perlindungan Rakyat Dan Pemulihan Ekonomi (PEMULIH) as specified below:

Households PEMULIH payments Proposed

Hardcore poor RM1,300 RM2,500

B40 RM800 RM1,900

M40 RM250 RM1,100

Additionally, we propose that the COVID-19 Fund be extended well after 2022 to reduce

a severe negative shock to a recovering economy. The extended expiry date should be

aligned with the 10-year period of looser debt-GDP and debt service ratios.

The concerns of the international rating agencies can be mitigated by having a clear fiscal

plan forward, which matters more than arbitrary spending limits. Since the start of the

pandemic, several countries worldwide have raised their spending limits without serious

threat to their credit ratings, including Brazil and Japan.

OTHER MEASURES TO CONSIDER

In addition, we call for an interest-free bank loan moratorium applicable to all except the

top 20%, which will help 8 million Malaysian individuals and companies. The cost should be

borne by the banking industry, which recorded a healthy profit after tax of nearly RM23 billion

for 2020 as compared to RM32.3 billion in 2019.

Finally, the National Recovery Plan should provide a comprehensive and detailed framework

on re-openings to reduce uncertainty. For example, Portugal’s Lockdown Easing Plan is a

useful case study in this regard as it provided clear guidelines at every stage, with emphasis

on minimising indoor activity and crowding while balancing the needs of businesses.

A key component of this plan is that it allowed all retailers of non-essential goods to operate at an

early stage as long as the transaction could be conducted with minimal or no contact, i.e. via

home delivery, takeaway, selling at the door or click and collect.

CONCLUSION

It is clear that the time to strike and make substantial cash injections into the economy is

now. Any delay will result in more jobs lost, leading to more Malaysians requiring economic

support to survive. The government will then have to fork out even more money to cushion

the impact, or face further decrease of economic growth.